Limited Company key dates throughout the financial year – your responsibilities and what you need to file with Companies House and HMRC

As a director of your Limited Company you’ll have legal responsibilities, including filing / submitting various forms and returning them to Companies House and HMRC throughout the financial year. If you’re new to running a Limited Company you may not be aware of what needs to be done and when, and it’s very easy to miss deadlines and get confused.

This blog will look at all the key dates you’ll need to be aware of, and what needs to be done.

Limited Company director – your responsibilities

As a director you have the legal responsibility to run your company, and are bound by a statutory code of practice that has certain legal obligations, which you have to meet.

When you form your Limited Company, you’re creating a separate legal entity from yourself personally, which contains its own legal framework and accountabilities, and its profits and losses belong to the company. Therefore any decisions you make must benefit the company, which also includes completing and filing the correct paperwork on time.

What do you need to file?

Accounting reference date and accounting periods for filing information – HMRC and Companies House set strict dates for filing in different ways:

When you first incorporate your company with Companies House, they will issue it an ‘Accounting Reference Date’. The first Accounting Reference Date is the last day of the month in which the first anniversary of incorporation falls. So the very first Accounting Reference Date for the first set of accounts you’ll file will usually have a longer period than 12 months. An example of this would be if you incorporated your company December 7th 2023, your Accounting Reference Date would likely be December 31st 2024.

For your company’s Tax Return and payment of Corporation Tax, HMRC will provide you with an accounting period, which begins once you’ve started trading, and ends on your Accounting Reference Date.

Confirmation Statement – contains information about your company, the director/s, and any other administrative arrangements you may have. It must also contain information about any Persons of Significant Control, who are involved in your company. You’ll complete one Confirmation Statement per year, or more should any of your company’s information change. Failing to file your statement within 14 days of the end of the ‘review’ period is a criminal offence, and if you’re a new Limited Company the review period begins on the date you incorporate, and ends 12 months later. Confirmation Statements only cover a 12 month period.

Corporation Tax Payment – Corporation Tax must be paid to HMRC if your company made a profit during the accounting period.

Form CT600 – You must file a CT600 form once a year with HMRC. This includes your company’s income details, minus any tax allowances or business expenses. What’s left is your taxable profit, and this is then used to calculate the total amount of Corporation Tax your company must pay. Your company’s very first Corporation Tax Return is due 12 months after your first yearend, and then within 12 months each year of your Accounting Period end.

National Insurance – If your salary exceeds the Primary Threshold of £12,570 per year, or £1,048 per month / £242 a week, then you must pay National Insurance.

If your pay exceeds the NI Primary Threshold you must pay Employee’s NI, and if you pay yourself or any employees / directors above the secondary threshold, your company must also pay Employer’s NI.

If you’re running your company’s payroll monthly, you’ll usually pay your NI also on a quarterly basis.

P60 – Shows the total amount you’ve been paid through your Limited Company, including the amount of tax you’ve paid to HMRC in that particular tax year. You’ll need to keep your P60 safe for when:

- You complete your Self Assessment

- If you need to reclaim any overpaid National Insurance or Income Tax

- Mortgage or loan applications

- Tax credits applications

Should your company have any employees, you’ll need to provide them with a P60 by 31 May every year.

P11D – summaries the value of Benefits in Kind (BiKs) that are given to employees and directors in any tax year – 6 April to 5 April. If you give BiKs to yourself, employees or directors who aren’t included on the payroll, then you must file a P11D with HMRC by July 6 following the end of the tax year, and keep a personal copy also.

PAYE – information is submitted to HMRC monthly.

Payment on account – If you owe any personal tax, you must make the following payments on account annually:

- 1st payment – must be made on account by January 31

- 2nd payment – must be made on account by July 31

Should the total amount of outstanding tax from the previous tax year exceed £1,000, you’ll need to also pay that amount plus a contribution towards the new tax year, based on an estimate provided by HMRC.

You’ll need to then make a second payment for the new tax year by July 31.

Self Assessment – Directors of Limited Companies must submit an annual Self Assessment Tax Return. This will detail your personal income and allowances to HMRC. You’ll need to include every detail from your company, and any other sources of income (ie rental or sole trader income).

Your Self Assessment must be completed and returned by January 31 every single year, but should you have your P60 sooner in the year, you’re able to also file your assessment earlier.

Statutory Accounts / Yearend Accounts – In accordance with the Companies Act 2006 and accounting standards, your company’s finances are made public every year. You’ll need to submit your company’s Income Statement, Statement of Financial Position, and other information in accounting notes. Your Company’s first accounting period is set to finish the last day of the month one year after it has been incorporated. Your first set of accounts are then due nine months after your company’s first yearend (or within 21 months of the company’s incorporation date, if the first accounting period is longer than 12 months).

Your deadline for submitting your yearend accounts to Companies House is calculated to the exact day, so don’t miss it!

VAT Return – If you’re VAT registered you’ll be required to calculate all of the VAT you’ve included to sales for the past year, and then deduct the VAT paid on business expenses. If you’re on the Flat Rate Scheme (FRS) you’ll have a limited cost trader rate of 16.5%, which is instead of reclaiming VAT on business allowable expenses.

All VAT records must be kept digitally, and use compatible Making Tax Digital (MTD) software to submit it.

Key dates to remember

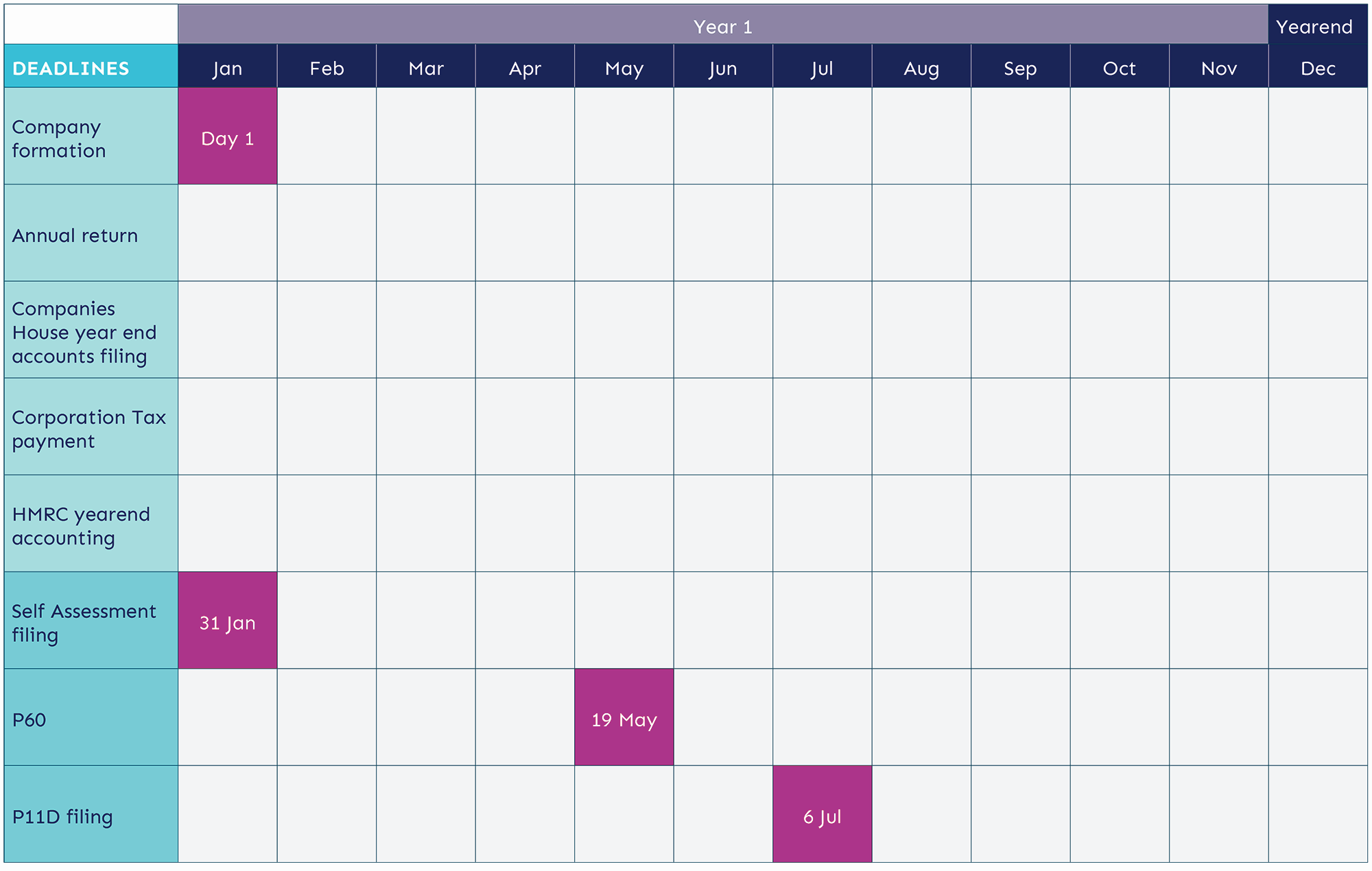

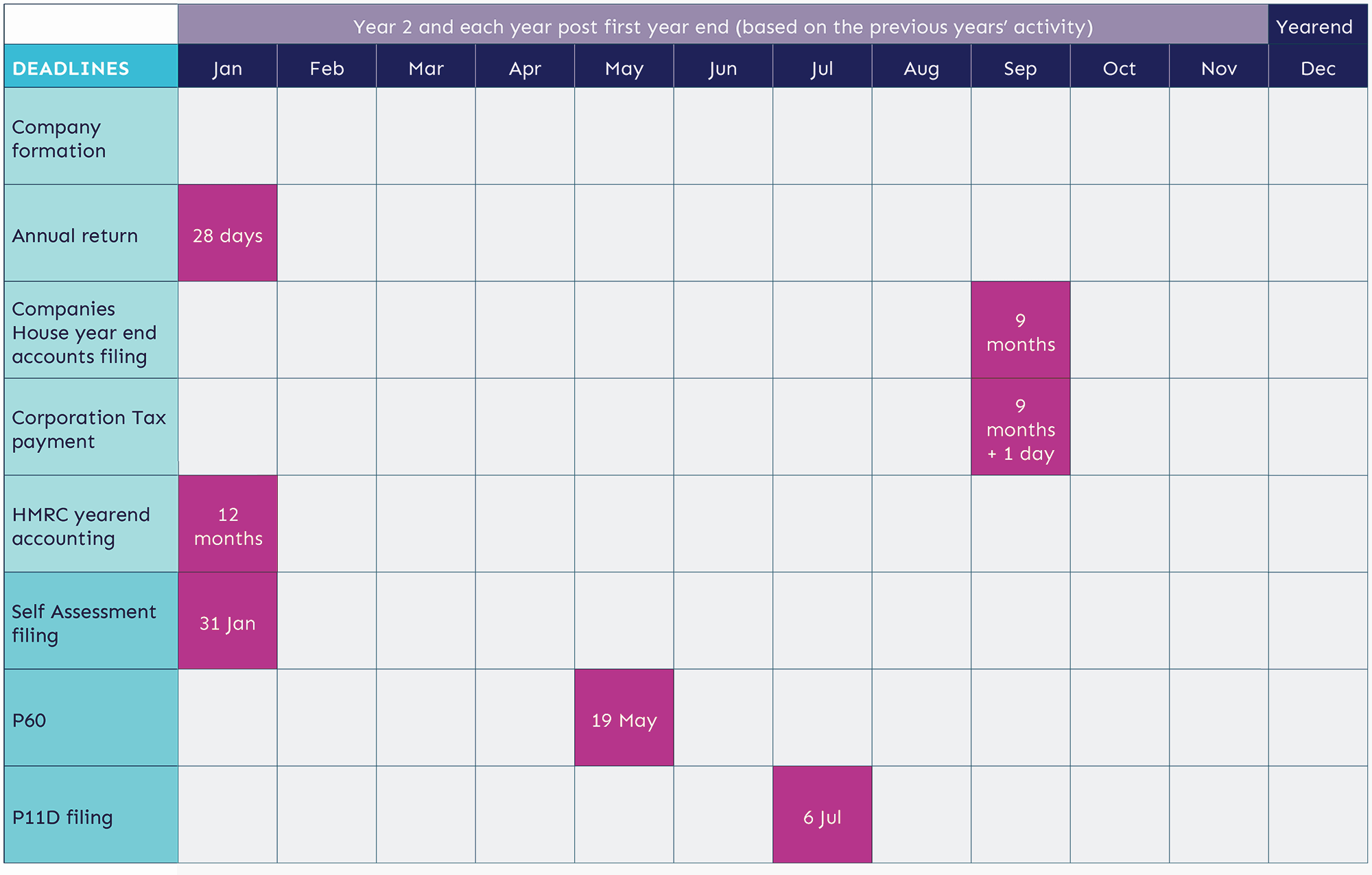

There’s a lot of information to remember, things to do, and get correct first time, along with running your Limited Company of course! That’s why we’ve created the following calendars to show you what a typical year’s deadlines could look like, if you were to incorporate your Limited Company on January 1.

Don’t let your responsibilities slow you down – let us help you out

Don’t let your responsibilities slow you down – let us help you out

When you’re busy running your own Limited Company, the last thing you’ll want to have to do is remember when certain things are due, how much and to whom. That’s where Taxevo comes in! With our team of expert accountants, ready to help you keep your company on the straight and narrow, and ensure your hard earnt small business money is working as hard as it possibly can for you. Why not get in touch today to find out more.