Category: Resources

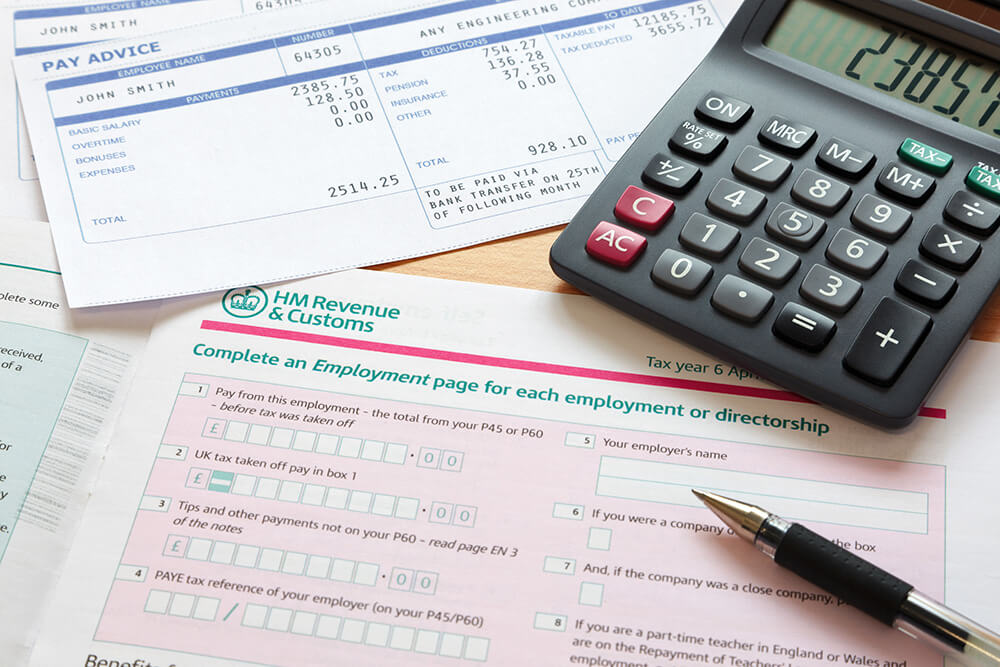

Sole Trader Expenses Guide – Reducing your tax bill with allowable expenses

Understanding what expenses can be offset against your income will help you bring down the amount of tax you pay to HMRC, meaning you keeping more of that hard earned cash. Here, we have put together some key expenses that ...

The Spring Statement 2022 – what it holds for freelancers and contractors

In this blog our MD, Daniel Mepham, shares his thoughts from the March 2022 Spring Statement. A much anticipated Spring Statement was delivered on March 23rd by Chancellor, Rishi Sunak against a backdrop of war in Ukraine, post pandemic super ...

How much tax can you expect to pay with an electric car?

Electric cars have never been so popular, and with the recently announced tax band changes now is the perfect time to consider purchasing one. So what are your options and are there any attractive tax benefits? In this blog we ...

Taxevo’s tips on how to save money as a freelancer

When you’re busy freelancing and focusing on bringing the money in, you might not be aware of things you’re doing (or not doing) that could mean the money is then slipping back out. In this blog we look at the ...

How to challenge your client’s IR35 status determination

From April this year, the way in which both private and public contract IR35 statuses are determined will be exactly the same. The rules for how they’re determined won’t change, but the person in charge of that decision will. In ...

Working from home? What expenses can you claim?

Since the start of COVID-19 working from home has gone from being a bit of a taboo subject to the norm, with many (if not all of us) now working from home. So you’re going to start to incur some ...

Guide to use of home as office

It is likely your permanent workplace will be your home and as such you can make a claim for using your home as your office. It may be that you complete fee earning work from home or simply just take ...

Guide to the Cycle to Work Scheme

As an employer, you can easily implement a tax exempt loan scheme for employees. To qualify for the tax exemption, the loan of bicycles and safety equipment must be available to all employees. What's the scheme all about? Employers who ...

Guide to the 24 month rule

As a contractor, the likelihood is that your workplace is deemed to be "temporary". If that is the case, you can claim travel and subsistence expenses during your time working at that location. How can I claim travel and subsistence ...

Guide to pensions and automatic enrolment

To comply with the Pensions Act 2008, employers must operate a workplace pensions scheme and contribute towards it. This is known as automatic enrolment. If you employ at least one person, you have certain legal duties. Does automatic enrolment apply ...

Guide to onshore agency reporting requirements

There is a requirement for all employment intermediaries and agencies to report details about their contractors on a quarterly basis. What's it all about? HMRC will require the following information: Full name National Insurance number (if no date of birth ...

Guide to conduct of employment agencies

What’s it all about? Introduced in 2004 to provide a framework for the minimum standards contractors should expect from recruitment agencies, the conduct of employment agencies regulations are aimed at the temporary workforce and those that are controlled by the ...

Guide to IR35

What’s IR35 all about? As a contractor it is important that you understand IR35 (also known as Intermediaries Legislation). Introduced in 2000 to stop people starting up limited companies to carry out the same jobs as permanent employees (known as ...

Expenses guide

It is important to understand all the business expenses you can claim when running a limited company. These are directly linked to the amount of tax paid and can help maximise your take home pay. Remember to keep receipts for ...

Guide to contracting

Making the jump from permanent employment to contracting can be daunting. It is important that you understand everything before making a change. Here, we summarise all the key points so you are set up for success in your contracting career. ...